- Tags: "First Home Buyers", "First National News", "Gold Coast Property", "News", "Property Investment", "Property Trends", "Real Estate", "Top Read"

First Home Buyers & Investors

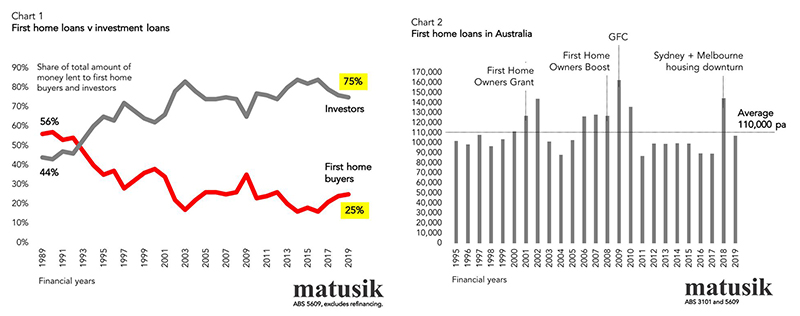

The above graphs came from a Michael Matusik article about first home buyers struggling to compete with investors for properties. On first glance you could think that by curbing investor demand you could suddenly make first homes more affordable.

Is that a fair assumption or are there more complicated forces work in the property market to cause the sustained increase in investor lending.

The first thing you need to realise is that first home owner loans over the past 25 years have been fairly consistent. If you allow for how first home owner grants, incentives and market downturns have tended to pull demand forward then you have a constant first home owner demand of between 105,000 - 110,000 homes per annum nationwide.

Every time there is a housing downturn there is a spike in first home loans as buyers move in to take advantage of the opportunities but the increase is not sustained, there is just not enough first home buyer demand in the market for it to stay at the higher level.

Secondly interest rates have been falling since the GFC to the extent that today a net return in the first year on a rental property is looking more attractive for a lot of retirees than holding cash.

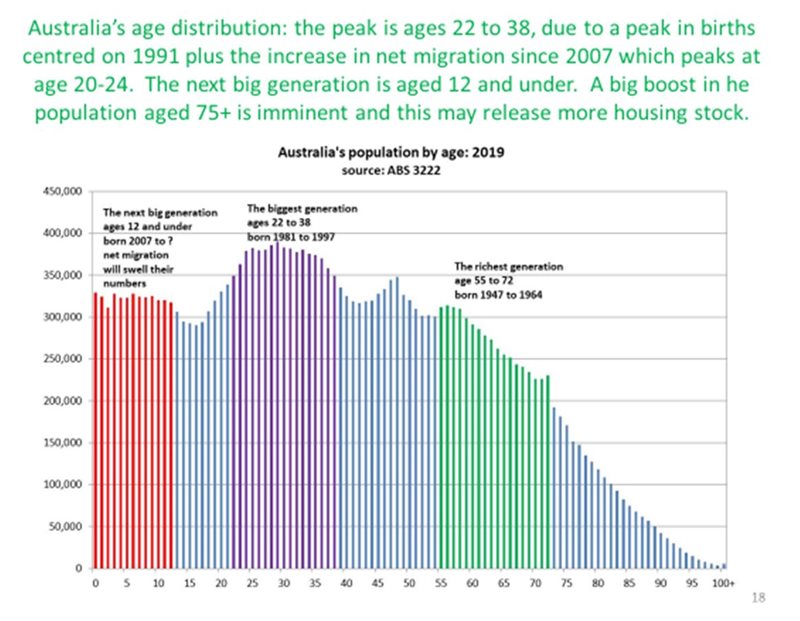

Next, by the time people turn 50 they are often out of their house mortgage and have the kids largely off their hands. That is when they turn to looking at their own future, their superannuation is not enough and it is pretty clear the pension will not do much for them so they look at buying an investment property. This trend has been very obvious in Western societies since about 2000 and it is reflected in the investment lending activity.

There are two great spikes in the Australian population, the baby boomers who drove the investment market for the last 20 years and are now starting to look at cashing in their investment properties as they age, the 40-55 population group who are buying many of the investment properties and the even bigger generation behind them who will maintain the momentum.

The idea that somehow governments can tip the balance in favour of first home buyers by discouraging people from buying investment properties without lowering prices generally and major rent rises has been proven not to work and at the last federal election was rejected by a strong majority.

The idea that somehow governments can tip the balance in favour of first home buyers by discouraging people from buying investment properties without lowering prices generally and major rent rises has been proven not to work and at the last federal election was rejected by a strong majority.

The Queensland government now plans to radically change the Residential Tenancies Act with the balance of power in the hands of tenants instead of the owners.

If the planned changes frightens existing and new investors out of the market it won't take many sales of investment properties to owner occupiers before there is a rental shortage and we see rent rises - up to $100 a week within 2 to 3 years is not reasonable estimate.

Palm Beach is in the midst of a unit building boom, this time so far with a surprisingly large number of owner occupiers, often downsizers, from within the local community. The new construction may be changing the town a bit but it brings us construction jobs now and increased economic activity when the extra residents move in.

When you start playing with these levers you better be sure about what is going to happen, experience tells me that we may not like the answers.

by David Hamilton

First Home Buyers & Investors palmbeachfn.com.au November 2019 First National Palm Beach

Cnr of 6th Ave & Cypress Terrace, Palm Beach, QLD 4221 Ph: 07 5559 9600