Real Estate Outlook Clearing

There is an old saying about newspapers, if it bleeds it leads, meaning put the bad news stories on page 1 if you want to sell more papers.

There is more than a fair amount of pessimism going around about the Gold Coast real estate market. That feeds into uncertainty about whether to act now or wait.

It's very hard to get good data about the Gold Coast property market from the local press even though we are one of the biggest population centres in the country

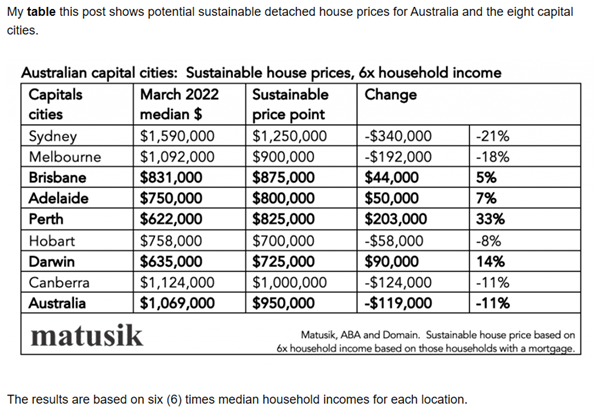

Based on mortgages being affordable at six times household earnings the four most resilient cities in the country are Brisbane, Adelaide, Perth and Darwin. All of these have a fair way to go before they break through any of the affordability rules into estimates being spread around by some people.

The size of the southern markets and their falls set the overall picture of the real estate market and at this stage are not directly relevant to the Gold Coast market.

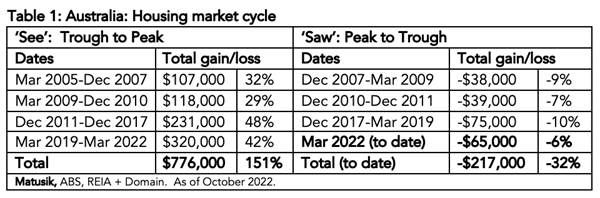

The first table below sets out the gains from real estate troughs to peaks. The table next to it shows the retreat from each peak. We covered rises in property values in a previous blog article which showed more than 100 years of median selling values. Profit at the peak is always accompanied by relatively minor falls and selling values during the downturn of the property cycle.

Nationally the median price of a house sold in October 2022 is down 6% from the peak median settlement price in March this year which is about where the Gold Coast sits - remember that house sale prices rose by $320,000 or 42% since the start of the Covid pandemic to March this year and let us not forget that the median sales price in Australian houses has risen from $335,000 in March 2005 to about $1,022,000 today {October 2022).

A lot of our clients have had those properties for the best part of 12 - 15 years so to imply that mortgage stress is widespread or that sales are going to fall by 20% during this downturn should be taken with the proverbial grain of salt or, in the case of the probability of a 20% fall of house prices here just plain ignored.

Some 3.6 million households have a mortgage in Australia 70% of those being owner occupiers and 28% investors. A recent analysis of the sales data suggests that 38% of the homes sold across Australia in the past three years were bought by first-home buyers (including investors) and 62% were purchased by changeover buyers or investors who hold another dwelling and/or principal place of residence as added security.

A recent ABS survey shows these recent buyers overall have a 34% equity in the home and or investment property. The ownership share increases to 44% for change over buyers and drops to 22% for first home buyers thus if you take a stab at it at most about 4% of Australians own more on the mortgages and their home/investment is currently worth but this doesn't mean much if they can keep up with their mortgage repayments. Nor is directly relevant to the Gold Coast where in a stronger market with strong employment growth it is nowhere near the same problem.

This is, in summary a good a time as any to sell or, if you're buying, the banks won't let you do anything stupid. If you're paying cash for a lifestyle change, a minor adjustment over the next 12 months in the value of the property will be uniform across the board.

In my opinion if you want a “canary in the coal mine” to where the real estate Gold Coast real estate market is going watch the unemployment figures. While our employment market is strong this market will be strong.

by David Hamilton

Managing Director | 0419 763 924

Changing Buyer Profiles

palmbeachfn.com.au November 2022

First National Property Solutions

Ph: 07 5559 9600