- Tags: "First Home Buyers", "First National News", "Gold Coast Property", "How To", "Landlords", "Law", "News", "Property Investment", "Property Trends", "Real Estate", "Selling Property", Tax, "Top Read"

Insight Into Property Market Trends

Depreciation data highlights changing habits

Producing tens of thousands of depreciation schedules Australia-wide has given BMT Tax Depreciation valuable insight into the property market and changing trends.

Recently, we’ve seen three main themes relating to the type, location and number of residential properties people are investing in.

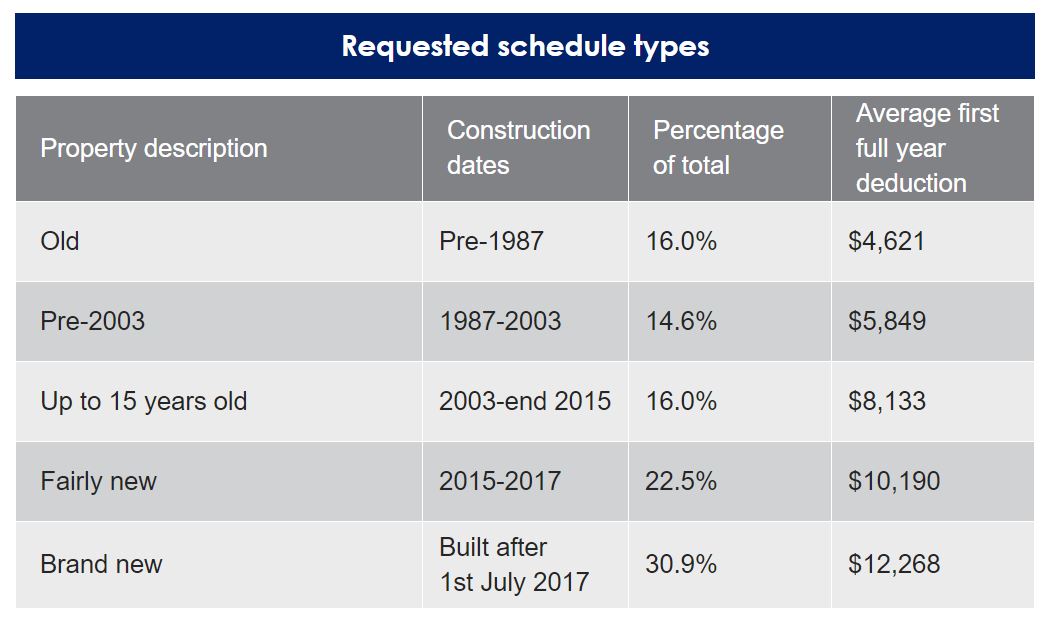

Firstly, we’ve seen a 4.5 per cent increase in investors buying new properties. 30.9 per cent of all depreciation schedules BMT completed for the 2017/2018 financial year were for brand-new properties compared with 26.4 per cent in 2015/2016.

Influencing this change was an increase in the supply of new apartments on the market, particularly in metropolitan cities.

Of the schedules ordered in the 2017/2018 financial year, we identified a 4.5 per cent increase in investors purchasing units rather than houses over the same period.

Amendments to legislation which came into effect on the 1st of July 2017 restricting some deductions that can be claimed for second-hand residential investment properties were also factors in this change.

Brand-new properties were unaffected by legislation changes to plant and equipment depreciation passed in 2017. As a result, investors are likely targeting these properties to optimise cash flow and maximise tax deductions.

For new properties built after the 1st of July 2017, BMT found investors an average of $12,268 in depreciation deductions in the first full financial year.

Despite this shift, investors haven’t stopped buying second-hand properties. Of the schedules completed during 2017/2018, 30.6 per cent were for older properties built before 2003 and 16 per cent were for properties up to fifteen years old. BMT found an average of $6,201 in depreciation in the first full financial year for all these properties.

The remaining 22.5 per cent of schedules completed were for ‘fairly-new’ properties built between 2013 and 2017. BMT found an average of $10,190 in depreciation in the first full year for these properties.

Even with changes to depreciation legislation, our data shows there are still substantial deductions available for those who invest in older properties.

The table below outlines the results of schedule types requested during 2017/2018.

As the table shows, even investors who purchased a property constructed prior to 1987 could claim an average first full year deduction of $4,621 in depreciation. Overall, we found an average depreciation claim of $8,212 in 2017/2018.

Furthermore, of those properties affected by changes to depreciation legislation, i.e. second-hand properties where contracts were exchanged after 7:30pm on the 9th of May 2017, BMT found investors still had an average claim of $5,651 in 2017/2018.

Our data also indicates the majority of investors purchase a property in capital cities. 61 per cent of all schedules BMT prepared during the 2017/2018 financial year were for metropolitan areas, compared with 39 per cent regionally.

According to CoreLogic’s January 2019 Home Value index, regional areas offer an affordable entry point into the market with a median value of $377,422 and a gross rental return of 4.2 per cent. This may result in investors continuing to target regional areas in 2019.

BMT data shows 79 per cent of investors who purchased properties in metropolitan cities only invested in their local area. 52 per cent of those who live regionally also invest within their geographical comfort zone.

When our staff speak to property investors, we always discuss their individual scenario, accounting for all properties they own.

In 2017/2018, 93 per cent of investors requested a schedule for just one property. This was up from 84 per cent in 2015/2016. In fact, the data shows just 6 per cent of enquirers owned two properties and 1 per cent owned three properties during 2017/2018.

Our data therefore continues to confirm that the vast majority of investors own just one property.

To learn about the 2017 depreciation legislation changes, visit bmtqs.com.au/depreciation-changes.

To request a free depreciation estimate and discover what you can claim for your property, speak with one of our expert staff on 1300 728 726 or visit bmtqs.com.au/estimate.

Assumptions and disclaimer: The depreciation deductions in this table have been calculated using the diminishing value method.

SOURCE: BMT QUANTITY SURVEYORS - MAVERICK - TAX DEPRECIATION

by BMT Quantity Surveyors

Insight Into Property Market Trends

palmbeachfn.com.au March 2019 First National Palm Beach Cnr of 6th Ave & Cypress Terrace, Palm Beach, QLD 4221

Ph: 07 5559 9600